NIC GENERAL INSURANCE CO. LTD offers a wide range of products and services in order to support SMEs in their business in the domestic and international market.

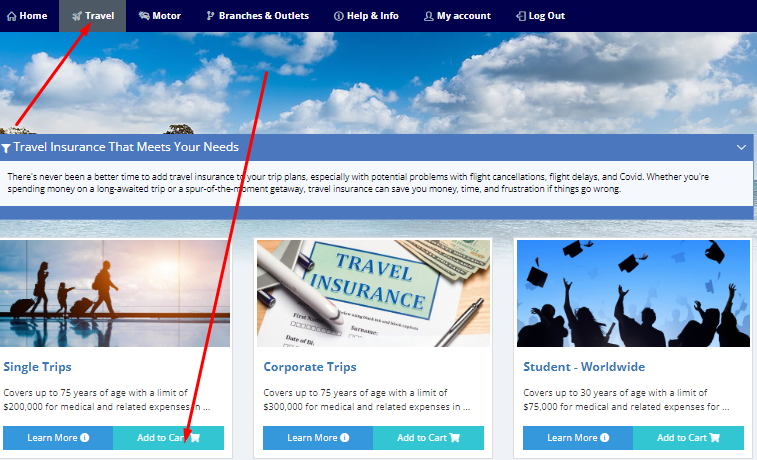

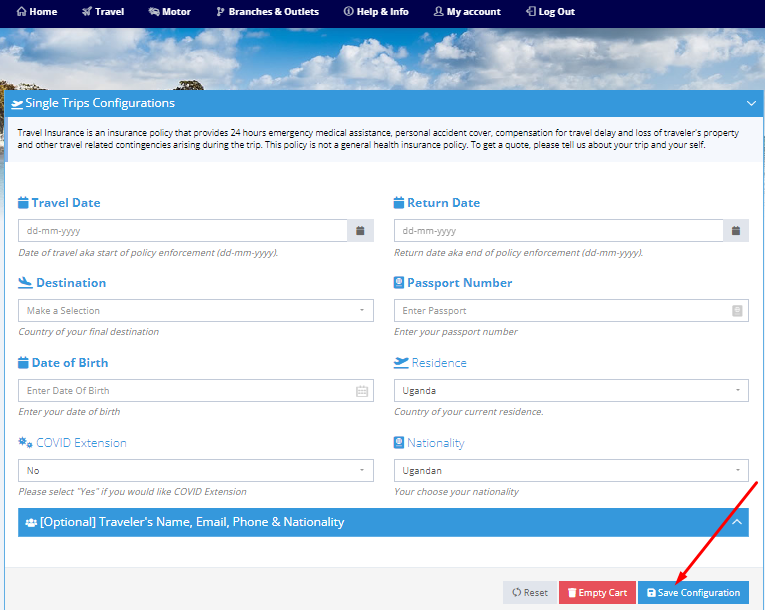

Single Trips

Covers up to 75 years of age with a limit of $200,000 for medical and related expenses in a single trip.

Corporate Trips

Covers up to 75 years of age with a limit of $300,000 for medical and related expenses in a single trip.

Student - Worldwide

Covers up to 30 years of age with a limit of $75,000 for medical and related expenses for all students all around the world with the exception of ...

Student - USA & Canada

Covers up to 30 years of age with a limit of $75,000 for medical and related expenses for students traveling to the USA and Canada only...

21 Days Multi Trips

Covers up to 75 years of age with a limit of $200,000 medical and related expenses for multi trips that is in one year for a period of 21 days

31 Days Multi Trips

Covers up to 75 years of age with a limit of $200,000 for medical and related expenses. for multi-trips that are in one year for a period of 31...

45 Days Multi Trips

Covers up to 75 years of age with a limit of $200,000 medical and related expenses for multi trips that is in one year for a period of 45 days.

Frequently Asked Questions

This refers to the maximum outstanding balance you can have on your account without being penalized. It can in simple terms be comparable to a flexible loan offered to you by a credit institution. On top of what you may have on your account, the credit institution would offer you a credit limit that allows you to go beyond your current account balance.

- NIC GENERAL INSURANCE CO. LTD as your credit issuer determines how much your credit limit is when you apply for one which usually depends on the level of trust from the company but also whether you give a security deposit or not. The instution assesses your income, current debt level, and credit history to make its decision. If you have a history of late payments or a significant amount of debt compared to your income, you may be approved for a low credit limit to start.

- Upon assessing your credit score, you are then required to sign a contract with NIC GENERAL INSURANCE CO. LTD that includes other terms and conditions for you to get the overdraft on your account. Once you have signed the contract, you are then eligible to withdraw money even if your account has zero balance on it which means that your account would ultimately have a negative balance.

- NIC GENERAL INSURANCE CO. LTD will charge you a daily compound interest on the negative balance that is on your account. Meaning as long as you have a negative balance on your account, 1% of that amount will be the charge you have to pay back as an interest. For instance in case you have withdrawn an overdraft of 100,000/-, you will be charged 1000/- the following day.

You typically won't know your credit limit until you've completed an application and it is approved.You will be offered a credit limit or an overdraft depending on whether you have given a security deposit or not or for a basic level if you meet the requirements set forth below. With your credit Limit, you will be able to withdraw money upto a negative balance on your account.

This means that if you have no balance on your account, NIC GENERAL INSURANCE CO. LTD will offer you up to a maximum of 100,000/- for the basic level where you offer no security deposit. In cases where you are to offer a security deposit, NIC GENERAL INSURANCE CO. LTD will offer you an amount of money that is half of the market price of the security deposit that you offer.

- You need to be 4 people to have access to the credit limit offered by NIC. Each of you will qualify to receive a credit limit of 100,000/= which you can also request for should you be interested.

- You will all be required to register for an account with NIC GENERAL INSURANCE CO. LTD if you have not already done so.

- You will also be required to submit your National IDs/Passport IDs for your identification

- You will then also be required to fill in a form which you will be signing, scanning and then re-submitting for approval. You can be able to access and download the form from here

HOW TO REGISTER FOR AN ACCOUNT

There are two ways through which you can register for an acccount as explained below:

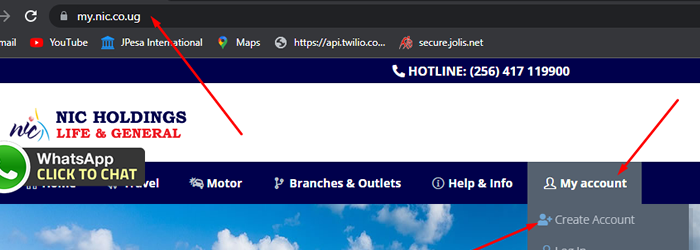

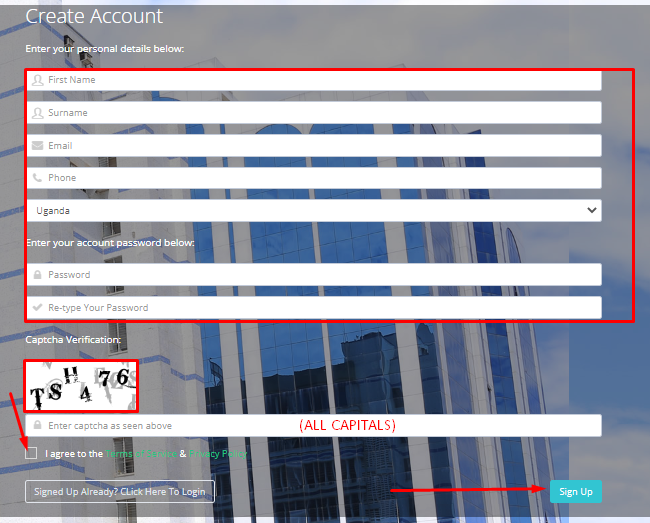

Using the Online NIC GENERAL INSURANCE CO. LTD Portal

- Visit our website to signup for an account in case you do not have one and if you already have one, you can simply signin.

- Follow our link here to learn about how you can submit your documents to our team for approval

- After you have logged in, navigate and click on your name at the top right hand corner and select My Profile.

- Locate My Documents and attach a soft copy of your ID which can be your passport ID, Driving Licence but preferably the National ID in case you have not already done so. Once it is approved and you have already signed the above contract for your Credit Limit, you chaould have access to the funds in your account. If on the other hand you have not received it, you can contact our team so that you can be advised.

You can alternatively use the WhatsApp option to be able to register and be eligible to receive the Credit Limit. You can be able to do so as follows;

- Add our WhatsApp number of +1 619-664-4376 to your numbers

- Send a Hi message to it where you will then receive an automated response from NIC GENERAL INSURANCE CO. LTD

- Select option number 9 of My Account and follow the prompts to submit your National ID

- You will then be given a response that your documents have been received

- Wait for your documents to be verified by the NIC GENERAL INSURANCE CO. LTD team

- Upon verification, you will then be eligible to not only send but also be able to withdraw funds

RENEWAL OF THE CREDIT LIMIT

NIC GENERAL INSURANCE CO. LTD will renew your credit limit every time that you pay it up. This means that if you had a credit limit of say UGX100,000 and you withdrew say UGX50,000, if you paid up the UGX50,000 plus interest you can then be able to qualify again for the UGX100,000 credit limit.

You can make purchases all the way up to your credit limit. You may not be able to go over your credit limit, though, if you haven't opted-in to having over-the-limit transactions processed. If you don't opt-in, transactions that could put you over your limit will be declined.

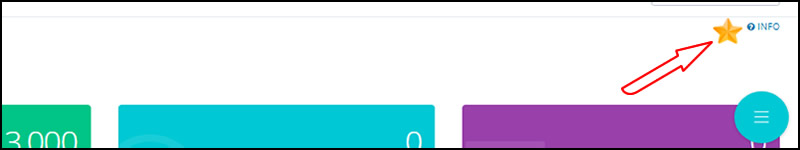

stars that you have in your account. This means that the more gold stars you have in your account, the more trustworthy you are to the company as well as the more benefits you are eligible for.

stars that you have in your account. This means that the more gold stars you have in your account, the more trustworthy you are to the company as well as the more benefits you are eligible for. - What does your profile rating mean

- Why you need a profile rating

- What is identity

- Purpose of verifying your identity

- Significance of identity verification

- When is the verification of identity required

- How is the verification of identity carried out

WHAT DOES YOUR RATING SCORE MEAN

Your rating score reflects the quality of your account profile as well as your ability to be eligible for certain benefits. NIC GENERAL INSURANCE CO. LTD uses this score and other stats from your profile to determine your level of trust as well as your ability to get certain benefits which otherwise you would not get if you had no rating.

If your star in your account is

(gray) in color as can be seen in the screenshot above, it means your account will have some limitations on it such as you will not have the ability to withdraw, you will not have access to a credit limit among other benefits that are provided by the company.

(gray) in color as can be seen in the screenshot above, it means your account will have some limitations on it such as you will not have the ability to withdraw, you will not have access to a credit limit among other benefits that are provided by the company.If the star in your account on the other hand is gold as can be seen in the screenchot above, it means that you atleast have one star in your account which gives you access to certain benefits such as mentioned before. You earn one gold star when you have provided your identification documents such as your National ID or Passport ID.

WHY YOU NEED TO VERIFY YOUR IDENTITY

Identity verification is a step beyond identification although it is still a step short of authentication. When we are asked to show a driver’s license, national id, passport, or other similar form of identification, this is generally for the purpose of identity verification, not authentication. This is the rough equivalent of someone claiming the identity "Kizito John," us asking if the person is indeed Kizito John, and being satisfied with an answer of "Sure I am" from the person (plus a little paperwork). As an identity verification, this is very shaky, at best.

We can take the example a bit further and validate the form of identification—say, a passport—against a database holding an additional copy of the information that it contains, and matching the photograph and physical specifications with the person standing in front of us. This may get us a bit closer, but we are still not at the level of surety we gain from authentication. Identity verification is used not only in our personal interactions but also in computer systems. In many cases, such as when we send an e-mail, the identity we provide is taken to be true, without any additional steps taken to authenticate us.

WHAT IS IDENTITY

Identity is the set of unique traits and characteristics associated with a unique and irreplaceable individual. This becomes essential when we talk about people and especially within the online environment, where identity theft is a more common phenomenon than we think. NIC GENERAL INSURANCE CO. LTD carries out identity verification upon document submission where after a user earns one gold star and then the color of their star changes to gold from the gray color.

PURPOSE OF VERIFYING IDENTITY

As more transactions move online, digitization of the ID verification process can drive significant efficiencies and create new channels for businesses to serve their customers; such as taking manual, face-to-face verification and streamlining it via online platforms. While many business processes are being modernized via digital technologies, ID verification is still slow, manual and prone to human error.

Unfortunately, ineffective manual ID verification is common place across both B2C and B2B companies. This typically results in bad customer experiences, fraud, and failure to maintain regulatory compliance. For many organizations, the ability to accurately verify ID in a timely manner is essential for business to function, allowing for the creation of contractual agreements, compliance with regulations, and delivery of services to customers.

By using digital technology to automate ID verification, organizations provide a smoother and more consistent experience for employees, customers and staff. This technology helps make it possible to onboard new employees who are working remotely, by scanning I-9 forms validating employee IDs digitally. Crucially, it minimizes risk by providing higher signer assurance, and facilitates compliance with regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML).

SIGNIFICANCE OF IDENTITY VERIFICATION

Maintain or Improve Your Reputation: Reputation is incredibly important for businesses of all sizes. In an age where there is so much consumer choice, it’s easy for people to hop from one brand to another if they don’t get exactly what they want. On top of this, trust is more important than ever before as consumers actively seek out businesses they can rely on. In an era of continual data breaches, consumers want to know that their information is safe. By running identity verification checks, this signals that you’re serious about building trust in what’s becoming an unsafe online world.

Avoid Costly Fines: Most businesses simply can’t afford a huge fine of this size, which is why AML and KYC systems are so important. AML refers to a collection of regulations, laws, and procedures that have been specifically constructed to stop the practice of declaring illegally obtained funds as legitimate income. This goes hand-in-hand with the need for KYC, which is essentially the process businesses go through to identify their customers and assess the risk of illegal activities.

Adhering to both of these protocols is important if you want to avoid costly fines – or, in some worst case scenarios, imprisonment. Implementing streamlined, efficient identity verification software and practices aligns with AML and KYC requirements, which means businesses that use them sidestep any potential fines. There are plenty of other individual rules and regulations that apply to businesses too depending on where they’re based and the customers they serve.

Avoid Costly Chargebacks: Credit card fraud makes up a huge portion of the total number of identity fraud cases every year. When businesses began allowing their customers to use credit cards for online purchases, it became far easier to commit fraud since most transactions fell into the “card-not-present” category. As a result, people would fraudulently use credit cards that weren’t theirs to buy goods online and, once the real owner of the card found out, would cancel the transaction.

Without being able to identify and trace the original fraudster, the business would be liable to pay back the money. This is known in the finance world as a chargeback. Unfortunately, they can be a costly part of business for companies that accept credit card payments (the industry standard rate is 1%). Identity verification stops this in its tracks by fully verifying each and every customer. For many businesses, preventing costly chargebacks is simply a case of revising identity verification protocols for card-not-present transactions so that they incorporate one or more identification methods (say, for example, facial recognition or a two-step verification process).

Tighter verification methods can also stop cases of “friendly fraud” in its tracks, too.Verification of identity increases customer trust because it creates a higher level of confidence that a person is who they say they are. Identity verification also ensures that there is a real person behind a process thus preventing both a person from carrying out a process on our behalf without authorization, and creating false identities or commit fraud.

Avoid Fraud and Money Laundering Concerns: Even an accusation of money laundering – however small – can spell the end of the road for a business, regardless of its size. As a result, organizations are leaning more and more towards using risk-based models that incorporate identity verification to assess which users might be high risk. They can then use this data to create authentication levels based on the risk potential of certain transactions (and then mark those that are good and those that might be fraudulent accordingly). This is becoming increasingly important as the business landscape gets more and more digitized. Making sure customers are who they claim to be is a major component in creating digital trust.

Improve Customer Experience: Today, consumers want a customer-centric experience with every business they buy from, and a great user experience strives to reduce any barriers that consumers might have while simplifying processes. The term "frictionless" is often thrown around in relation to good identity verification processes – this means not asking the customer for too much information and instead obtaining information about them in other places.

This means you can create a well-oiled, digital workflow that eliminates most – if not all – need for manual entry and paperwork which can often take a number of days to process. As a result, customers get a smoother onboarding experience and, more importantly, can get instant access to your product or service.

WHEN IS THE VERIFICATION OF IDENTITY REQUIRED

Verification is needed as soon as you have registered for an account. However, this does not prevent you from receiving a payment from your clients who may want to make a payment to you. In such cases where you may not have your ID with you, NIC would allow you to receive the payments but then require to submit your ID when you are going to withdraw the money.

HOW IS THE VERIFICATION OF IDENTITY CARRIED OUT

NIC GENERAL INSURANCE CO. LTD will do a preliminary investigation on the documents that you submit to make sure that there is consistency in the person creating the account. This is done by matching the names on the ID submitted with the account that was created. In case these two do not match, your ID will not be approved otherwise if all is OK, your documents will be approved by the NIC GENERAL INSURANCE CO. LTD team.

Thereafter where necessary, NIC GENERAL INSURANCE CO. LTD may even contact you where necessary to confirm if you are who you say you are in regards to the submitted documents.

Who are Sales Agents?

Sales Agents are also known as Securities and Commodities Sales Agents and they basically do business on behalf of individuals, businesses and or organizations with authorization. Their job is to basically buy and sell securities in investment and trading firms and develop and implement financial plans for individuals, businesses, and organizations.

What do Sales Agents do?

Sales Agents keep accurate records of transactions by reviewing all security transactions to ensure accuracy of information and conformance to governing agency regulations.

They do also carry out the following tasks:

- Complete sales orders and submit them for processing of client-requested transactions.

- Contact prospective customers to determine customer needs, present information, or explain available services.

- Interview clients to determine clients’ assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Develop financial plans, based on analysis of clients’ financial status.

- Analyze market conditions to determine optimum times to execute securities transactions.

- Review financial periodicals, stock and bond reports, business publications, or other material to identify potential investments for clients or to keep abreast of trends affecting market conditions.

- Inform and advise concerned parties regarding fluctuations or securities transactions affecting plans or accounts.

What are Agent Payments?

Sales Agents are also known as Securities and Commodities Sales Agents and they basically do business on behalf of individuals, businesses and or organizations with authorization. Their job is to basically buy and sell securities in investment and trading firms and develop and implement financial plans for individuals, businesses, and organizations.

What do Sales Agents do?

Sales Agents keep accurate records of transactions by reviewing all security transactions to ensure accuracy of information and conformance to governing agency regulations.

They do also carry out the following tasks:

- Complete sales orders and submit them for processing of client-requested transactions.

- Contact prospective customers to determine customer needs, present information, or explain available services.

- Interview clients to determine clients’ assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Develop financial plans, based on analysis of clients’ financial status.

- Analyze market conditions to determine optimum times to execute securities transactions.

- Review financial periodicals, stock and bond reports, business publications, or other material to identify potential investments for clients or to keep abreast of trends affecting market conditions.

- Inform and advise concerned parties regarding fluctuations or securities transactions affecting plans or accounts.

Below you will find some of the types of accounts that you can be able to open up and the required documents for each. You can jump to particular sections of these documents by using the following links below:

- Individuals

- Limited Companies

- Sole Proprietor

- Savings and Credit Cooperatives (SACCOs)/Non-deposit taking microfinance institutions/ /Money Lending companies

- Non-Governmental Organizations

- Community based organizations, Clubs and Associations

- Faith Based Organizations – Churches, Mosques etc

- Schools, Education Institutions

- Partnerships

- Embassies

- Trusts

- Political Parties

- Ministries/Public Sector/Government

- Banks Financial Institutions

- Why should you submit your documents?

- How do you submit documents to NIC GENERAL INSURANCE CO. LTD?

What kind of documents can you submit to NIC GENERAL INSURANCE CO. LTD?

INDIVIDUALS

The following documents are required to be submitted by the applicant in the process of creating an account for individuals

- Identification Documents (Acceptable IDs)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID ➢ National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

- Proof of residence/ address verification include any of the following

- Letter from a public authority or embassy or consular office

- Utility Bills in the customer’s name and not older than 3 months

- Where utility bill is not in the name of the customer obtain a copy of the tenancy agreement

- Letter of recommendation from employer

- LC Letter confirming residence

- Letter from School/ University administration in case of students

- Bank statement from existing or previous bank bearing the current customer’s address.

- Certificate of residence for foreigners

- Proof of Income/Source of Income

- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for Limited Companies

- Certified board resolution to open account stating authorized signatories

- Certificate of Incorporation certified by the Company Registrar

- Certified Memorandum and Articles of Association

- Certified Particulars of Directors and Secretaries i.e. Form 20 (formerly form 7)/Notification of change of directors and company secretary

- Certified copy of Particulars of Business Address i.e Form 18 (formerly form A9)

- Trading License. A company licenced under a different law, should submit a copy of the applicable license

- Tax Identification Number (TIN), or Tax Exemption Certificate

- Company search

- Identity Documents of related parties and beneficial owner.

A beneficial owner is an individual with shareholding > 10%, A related party is a Director and authorized Account Signatories.- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for sole propretors

- Certificate of registration of Business Name Certified by the Company Registrar

- Statement of particulars pursuant to the registration of business name

- Trading License

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for SACCOS

- Certified copy of the certificate of registration of the SACCO issued under Cooperatives Societies Act

- License from Tier 4 Microfinance Institutions Authority

- Constitution/ By Laws or Certified Memorandum and Articles of Association of the entity

- Identity Documents of Primary and related parties such as Directors and Account Signatories. (National ID for nationals OR Passport for Foreigners OR Refugee ID for refugees)

- Minutes authorising account opening and appointing current management and signatories

- Letter requesting for account opening stating signatories

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office.

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for NGOs.

- Certified Copy of License from the NGO board

- Certified copy of Certificate of Registration/Incorporation

- Constitution/ By Laws Or Certified Memorandum and Articles of Association

- Registered resolution indicating the current Board members/Executive committee & period of validity in office. In case of any change another resolution and Minutes electing the current sitting Board should be shared

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID > National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

The following documents are required to be submitted by the applicant in the process of creating an account for CBOs, Clubs and Associations

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Minutes of meeting resolving to open the account and stating signatories

- Constitution/ By Laws or Certified Memorandum and Articles of Association

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for FBOs, Churches and Mosques

- A recommendation letter to open an account from the Vicar/Secretariat of the religious faith for the mainstream churches/mosques

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Constitution/Charter

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for Schools, Education Institutions

- School Registration Certificate issued by Min of Education & Sports for private institutions

- License from the Ministry of Education for private institutions

- Authorization to Open account duly signed by District or Town representative (CAO or District Education Officer or Town Clerk) OR Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for partnerships

- Certified Certificate of Registration

- Certified copy of Partnership Deed

- Certified Statement of particulars pursuant to the registration business name.

- Authorization to Open account duly signed by Partners stating signatories.

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Tax Identification Number (TIN), or Tax Exemption Certificate where applicable

- Trading/Operating License.

- Proof of Address any of the following below can be obtained;

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for Embassies

- Authorization to Open account duly signed by the Ambassador stating Signatories.

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Proof of Address any of the following below can be obtained;

- Recent Utility bills not older than three months,

- Bank Statement bearing customer’s address.

- Tenancy or Lease Agreement

- Letter of authorization to open account indicating address on letterhead

- Tax Identification Number (TIN), or Tax Exemption Certificate

- Group Sanctions Desk Authorisation

The following documents are required to be submitted by the applicant in the process of creating an account for individual

- Certified Certificate of registration

- Certified copy of Trust Deed

- Certified Resolution/ Authorization to Open account stating signatories

- Identity Documents of persons having senior management positions or trustees of the trust, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

The following documents are required to be submitted by the applicant in the process of creating an account for Political Parties

- A certified copy of their registration Certificate from the Electoral Commission.

- A certified copy of the party Constitution that is filed with the Electoral Commission.

- A Resolution of the party to open an account stating signatories

- Identity Documents of the Party President, Secretary General and Treasurer of the party and account signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees).

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- Letter of authorization to open account indicating address on letterhead

The following documents are required to be submitted by the applicant in the process of creating an account for ministries/public sector/government

- Letter requesting for opening of account signed by: Town Clerks/Permanent Secretaries/Chief Administrative Officer (CAO)/Executive Directors stating signatories

- Letter of authorization for account opening from the Accountant General or Board of the Public-Sector entity.

- Identity Documents of Directors and Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Letter of Authorisation indicating address

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- Proof of residence/ address verification include any of the following

- Letter from a public authority or embassy or consular office

- Utility Bills in the customer’s name and not older than 3 months

- Where utility bill is not in the name of the customer obtain a copy of the tenancy agreement

- Letter of recommendation from employer

- LC Letter confirming residence

- Letter from School/ University administration in case of students

- Bank statement from existing or previous bank bearing the current customer’s address

- Certificate of residence for foreigners

- Proof of Income/Source of Income

- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

BANKS/FINANCIAL INSTITUTIONS

The following documents are required to be submitted by the applicant in the process of creating an account for Banks/financial institutions

- Certified Certificate of Incorporation (Notarised for foreign banks)

- Certified List of Directors and Secretary/Trustees i.e. Form 7/20 (Notarised for foreign banks)

- Certified Memorandum and Articles of Association. (Notarised for foreign banks)

- Latest Annual Report

- Valid Operating License issued by the respective regulator

- Profile of Senior Management and Board

- Proof of Address i.e. Certified copy of company form 18 (formerly A9) or License indicating address for foreign banks/extract from the regulators website indicating the bank’s address

- Certified Board Resolution/ Authorization to open account/SWIFT request for foreign banks

- Tax Identification Number (TIN), or Tax Exemption Certificate / W8-BEN form

- Copy of the AML policy

- Wolfsberg Questionnaire (Not older than 6 months)

Why should you submit your documents to NIC GENERAL INSURANCE CO. LTD?

- They act as proof of Identification

- They help protect your funds

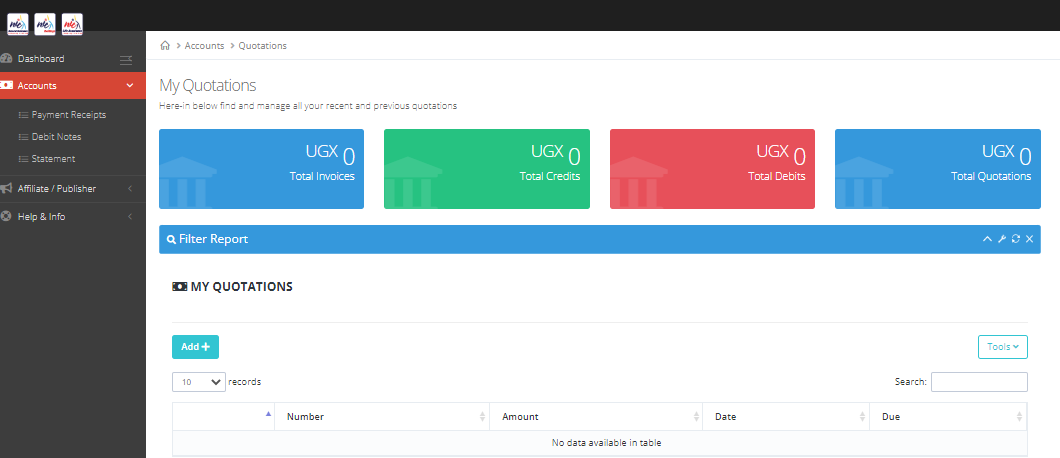

Attaching and submitting your documents to NIC GENERAL INSURANCE CO. LTD is so easy. The following are the instructions to guide you on how to submit your documents

- Login to your NIC GENERAL INSURANCE CO. LTD Account

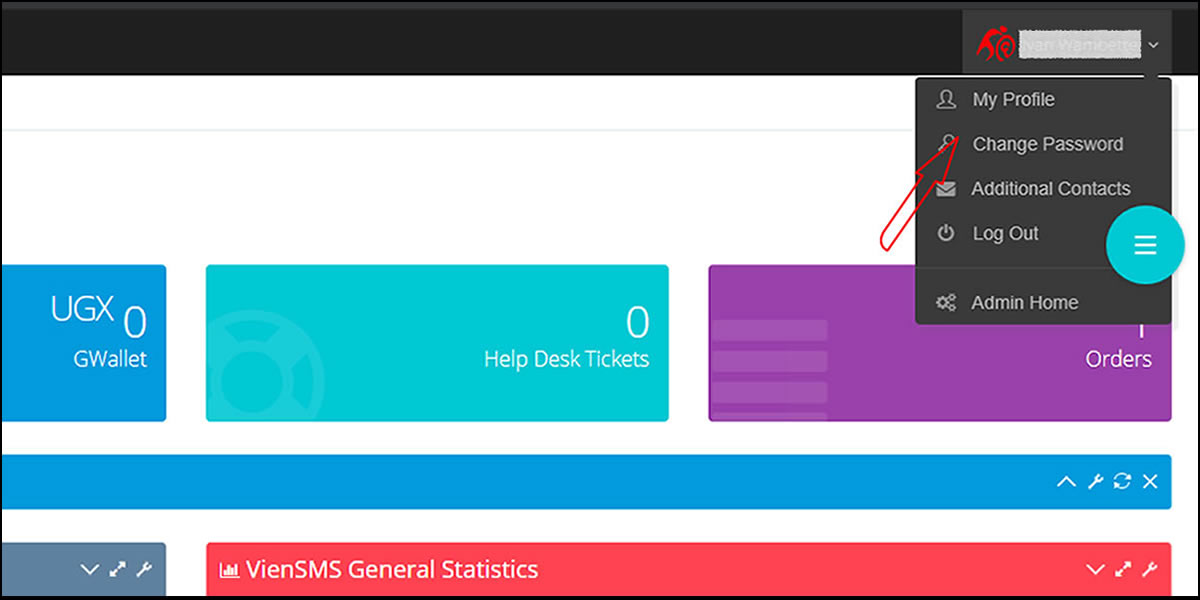

- Navigate and click on your name at the top right hand corner

- Select my profile from the drop down menu

- Locate and click on the documents tab

- Navigate and click on the Add button

- Enter the details such as the subcategory, document name and some comments

- Click on Save Document

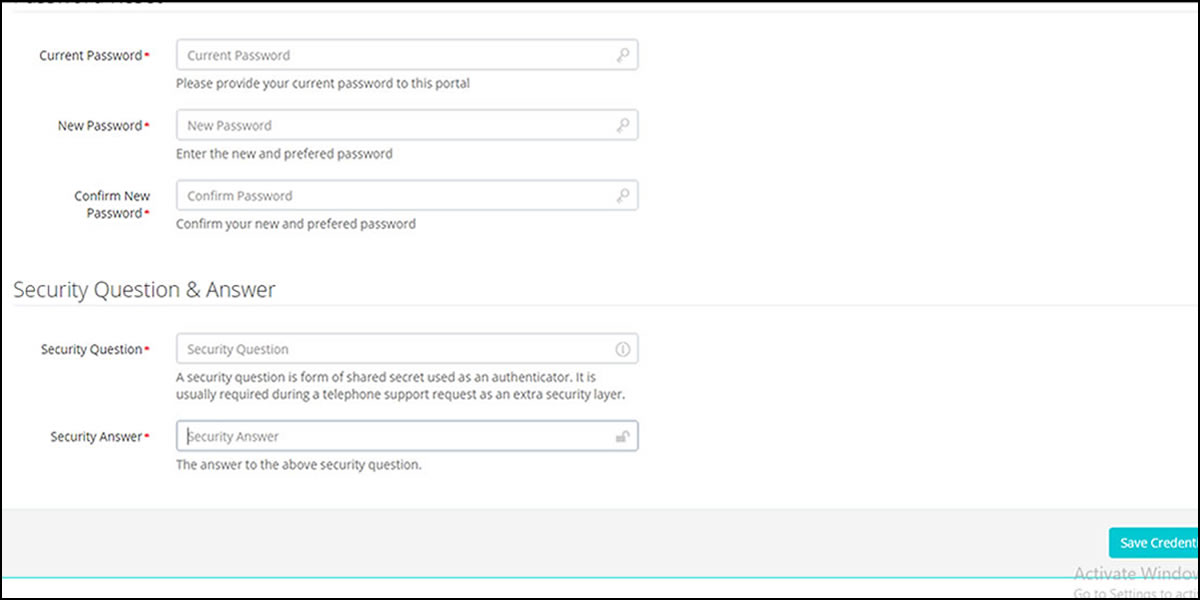

Either way, your password will be changed and in this article we will be explaining the two ways to have it changed.

TIPS FOR CREATING A SECURE PASSWORD

Having a secure, unique password for each of your online accounts is critically important. If a scammer gets just one password, they can begin to access your other accounts. That’s why it’s important to have a strong, unique password for your NIC GENERAL INSURANCE CO. LTD login.

A strong password should have the following characteristics:

- More than 8 characters long

- Use lower case, upper case, a number, and a special character [like ~!@#$%^&*()_+=?><.,/]

- Not a word or date associated with you (like a pet's name, family names, or birth dates)

- Use a password that you'll be using only for your NIC GENERAL INSURANCE CO. LTD account

- A combination of words with unusual capitalization, numbers, and special characters interspersed. Misspelled words are stronger because they are not in the dictionary used by attackers.

- Keep your password secret. We'll never ask for your password by email, instant message or phone

- Something you can remember

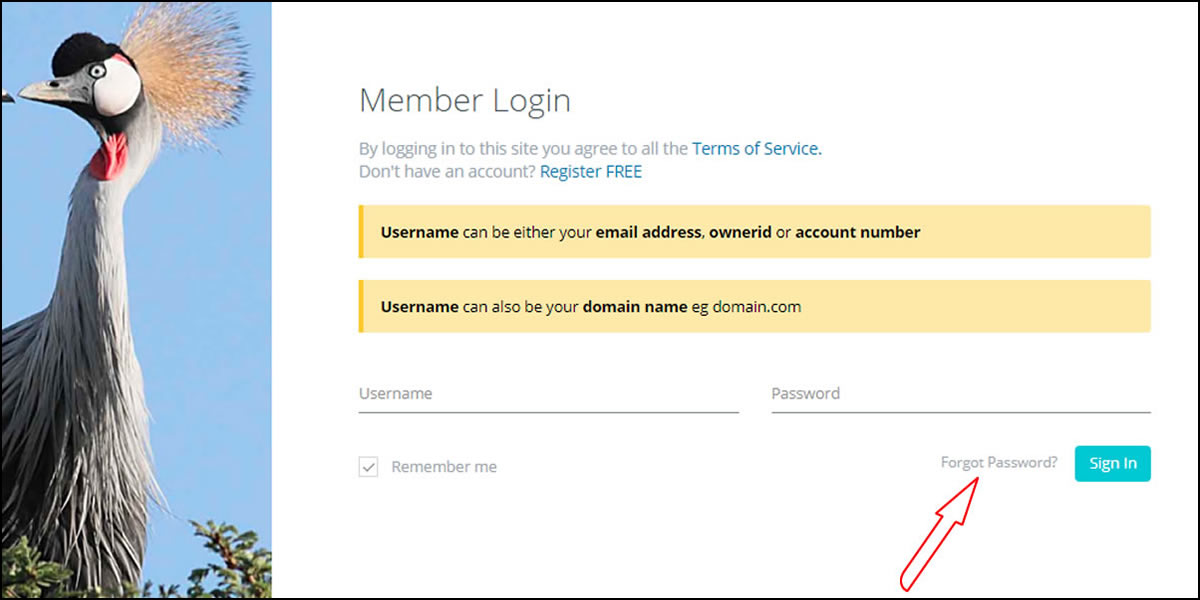

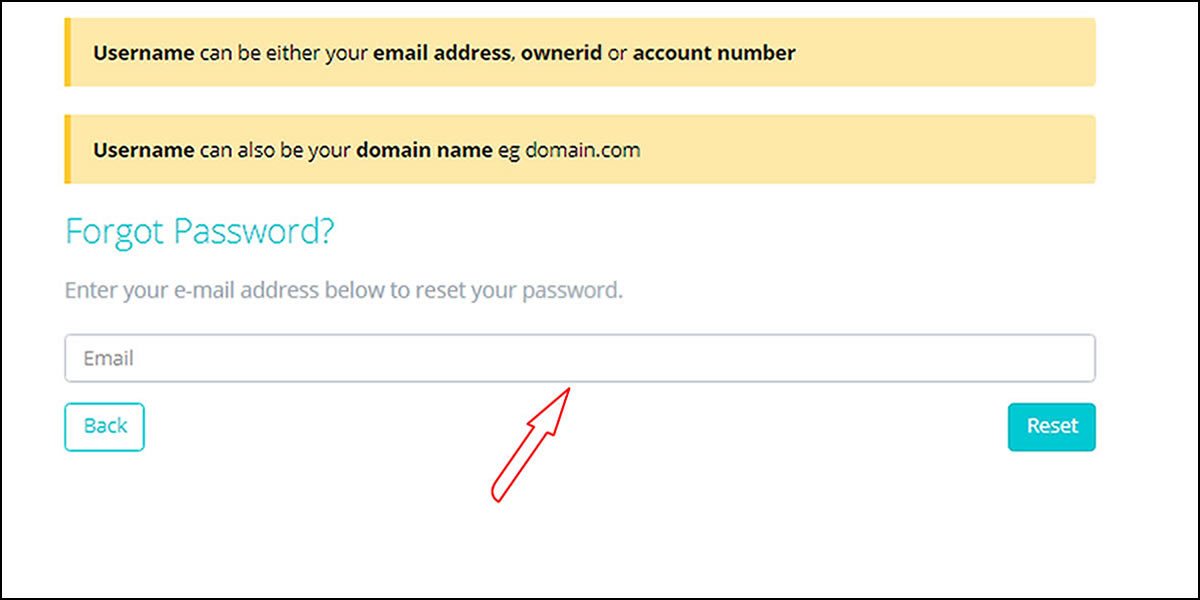

RESET YOUR PASSWORD ON THE LOGIN PAGE

- Go to the login page and click on forgot password as shown in the attached figure below

- Enter the email address associated with your NIC GENERAL INSURANCE CO. LTD account for you to receive the reset password

- Login to the respective email address and look for the reset password that has been sent to it

CHANGE PASSWORD THROUGH YOUR ACCOUNT

Navigate to the top right hand corner and click on your name to open a menu as shown in the figure below.

Click Change Password

If you can't remember your old password, you can reset it on the login page and check the email associated with your NIC GENERAL INSURANCE CO. LTD account for the reset password.

Click Save Credentials How to fix common issues that can affect the password reset process I can't find the password reset email in my inbox

If you have asked the system for a password reset and after a couple of minutes you still haven't received the password reset email:

- Please ensure to check your spam/junk folders in case the email has been filtered out.

- Some email software sends filtered emails to their "deleted folder" or "waste bin" even though they also have a spam folder, so make sure to check there as well.

- If you do find the email in any of these folders, please make sure to whitelist our email address.

If you have asked the system for a password reset and after a couple of minutes you don't have the email in inbox nor in junk/spam/deleted folders:

- It might be better to wait at least 5 or 10 minutes rather than try requesting another password reset right away. This is in case your email provider is experiencing a delay in processing the email our system sent.

- If you do decide to try requesting a new password reset email without having received the first one, please keep in mind that you might first receive the previous password reset email. In this case, the first email will have an expired password, because the reset passwords expire as soon as a new password reset is requested. Make sure to always use the absolute last password reset email you have received.

We recommend you change your password and security questions from time to time. There are a few cases where it's a good precaution, for example:

- You notice something suspicious on your NIC account

- You suspect that someone you don't trust has your password

- You notice something suspicious in your email account or other online accounts

- You have recently removed malware from your system

- NIC asks you to change your password

If one of these occurs, change your Password, PIN, and security questions immediately. You can change these under personal settings.

If you receive an email asking you to change your password, it could be a case of phishing. Instead of clicking on a suspect link in an email, just log into your NIC account by manually typing the URL. Click the Settings tab, and then Personal Info. You will find the password, security questions, and PIN (if you've set one up) on this page.

Submitting a Ticket Request

When it comes to getting support from us at NIC GENERAL INSURANCE CO. LTD, submitting a support ticket is one of the best ways to request assistance. To help with this task, it can be helpful to realize the way that our ticketing system works.

In this article we'll go over the types of support requests, the differences between support requests, checking on the status of a support request, submitting a support request, adding details to a support request, and finally what we see when you submit a support request

Types of Support Requests

When submitting a support request, there are three different types of requests:

- Non-verified question to our Customer Community: A Non-verified question means that we will look into and respond to your issue in our public Q&A section of our website. These are typically for questions outside of the general scope of our Support Team.

- Verified ticket submitted through AMP: This method is the easiest way to contact Technical Support. It is preferred because it provides a contact that does not require further verification.

- Non-verified email to support@jolis.net for Technical Support, or to billing@jolis.net for Customer Service Support: A Non-verified email means you might have to confirm your account with either the current AMP password for your account or just the last 4 digits of the credit card on file.

Verified vs. Non-verified Support Requests

The main difference between a Verified and Non-verified support request comes down to the information we can relay to you, as well as any account changes that we can make for you.If you just need to ask us a quick general question a Non-verified support request is fine. We will be able to provide general assistance (without making changes to your account) and will not divulge any account specific information. However, if your request requires that we give you specific information about your account or make any adjustments on your behalf, you must submit a Verified request.

Submit a Support Request

When you need to submit a Support request to us there are two (2) methods you can use to submit a ticket.Submit a Verified Ticket from AMP

- Log into [[UN]] Account.

- Navigate to Help Desk under Help & Info.

- Click the Submit New Ticket button

Submit a Non-verified Ticket via Email

If you would like to submit a Support request to us, by sending an email, you can simply send an email to us at support@jolis.net.Simply provide either your account’s current AMP password or just the last 4 digits of the credit card on file in the body of your initial email to verify your account.

Checking a Support Request Status

Once your initial request is received a ticket is created and queued. We answer all tickets in the order that they are received. There are only three possible statuses for tickets: open, hold or closed. While the ticket is in queue and/or being worked on, the status is open. Once a technician responds to your request, you will receive an email and the ticket will be closed. This email includes the technician’s response and the complete email thread (beginning with your initial request). When you reply to their email, the ticket is reopened with your response and again, handled in the order it was received.Request Submitted

What You See

After you submit a ticket, you should receive a confirmation email from our system with your ticket ID.Now you just need to wait while we review your support request in our ticketing system. You will get an email from us again once one of our support staff replies to your ticket. In this case they responded with the text “Staff response”.

What We See

When you first submit your ticket, it will be assigned to our Tier1 Support Team to investigate further.Adding Details to an Open Ticket

If you need to add more details to your support request, you can simply reply to the email you receive from our ticketing system without altering the subject.Need Immediate Help?

As always we are here to help, so if for some reason you need immediate assistance with your support request please start a Live Chat session with us or give us a call at 0800-1-JOLIS(56547).Travel Insurance covers a host of insurable incidents. The exact roster of instances varies from one plan to the next. But broadly speaking, here’s what you can expect a Travel Insurance plan to cover:

- Personal accident cover

- Hospitalization expenses

- Trip delays, cancellations or interruptions

- Loss or damage to baggage checked-in

- Loss of passport

Medical and related expenses

Cover provided for medical expenses related to illness or injury, including hospital and doctor’s costs, prescription medication, surgery, evacuation and repatriation

Personal Accident Insurance

Capital sums aid in the event of death or permanent total disability following an accident. Medical expenses following an accident are covered under the medical section

Personal Liability

If you become legally liable for accidental death, bodily injury or illness of any person or loss or damage to property, we will pay for claims made against you. We exclude liability from you being in control of a mechanically propelled vehicle

Journey Cancellation

Cover for non refundable payments if you have to cancel your journey as a result of illness, injury or death. Terms and conditions apply

You may cancel you policy at least three (3) working days before the policy start date by informing us in writing and providing the following;

- Completed cancellation form

- Visa rejection letter in case of visa denial by the embassy

Motor Insurance is also called as Car (Two Wheeler) insurance, Vehicle insurance or Auto insurance. As the name suggests, a motor insurance is an insurance for two wheelers, cars, trucks, motorcycles, etc. The basic purpose of Motor insurance is to provide financial protection against physical damage to the vehicle or bodily injury to third party as a result of accidents, collisions apart from liabilities arising from such incidents. Motor insurance gives protection to the vehicle owner against;

(i). damages to his/her vehicle

(ii). pays for any Third Party Liability determined as per law against the owner of the vehicle. Third Party Insurance is a statutory and legal requirement and hence every vehicle owner should mandatorily insured his/her vehicle at least for Third Party cover. The owner of the vehicle is legally liable for any injury or damage to third party life or property caused by or arising out of the use of the vehicle in a public place.

Motor third party insurance was introduced by the Motor Vehicle Insurance (Third Party Risks) Act in 1989. The Act provides for compulsory insurance against third party bodily risks in respect of the use of vehicles.

It is mandatory that any vehicle, van or motorcycle for private or commercial use should have Motor Third Party insurance cover. The law only exempts Government owned vehicles.

The person who benefits from Motor Third Party is a third party who suffers loss or death or bodily injury as a result of an accident. This maybe any road user, such as a pedestrian, a motor vehicle passenger, a property owner involved in an accident.

The first party is the owner of the vehicle or motorcycle whereas the insurance company is the second party.

Please note that this type of insurance protects the interest of only third parties, not yours.

In addition to third-party liability, a comprehensive insurance plan protects your vehicle against risks like theft, vandalism, and fire. It also covers you if your car or bike suffers any loss or damage due to natural or man-made disasters such as floods, cyclones, earthquakes, riots, and so on.

Your insurance policy follows the vehicle, not the driver. If your vehicle is being driven by someone else with your permission, the insurer will still be liable to pay for damages up to the sum assured.

Once you have intimated the insurer, you will be provided with a claim number. On submitting the required documents, your claim will be processed within a short period of time in accordance with the policy’s terms and conditions.

A commercial car has a higher exposure to risk as it is used more than a private car. The vehicle will be used repeatedly to carry out commercial activities, which makes it vulnerable to accidents and third party liabilities.

A private vehicle Insurance is a type of insurance policy meant for cars that cannot be legally used for commercial or business activities such as transporting goods or people from one place to another.

This refers to the maximum outstanding balance you can have on your account without being penalized. It can in simple terms be comparable to a flexible loan offered to you by a credit institution. On top of what you may have on your account, the credit institution would offer you a credit limit that allows you to go beyond your current account balance.

- NIC GENERAL INSURANCE CO. LTD as your credit issuer determines how much your credit limit is when you apply for one which usually depends on the level of trust from the company but also whether you give a security deposit or not. The instution assesses your income, current debt level, and credit history to make its decision. If you have a history of late payments or a significant amount of debt compared to your income, you may be approved for a low credit limit to start.

- Upon assessing your credit score, you are then required to sign a contract with NIC GENERAL INSURANCE CO. LTD that includes other terms and conditions for you to get the overdraft on your account. Once you have signed the contract, you are then eligible to withdraw money even if your account has zero balance on it which means that your account would ultimately have a negative balance.

- NIC GENERAL INSURANCE CO. LTD will charge you a daily compound interest on the negative balance that is on your account. Meaning as long as you have a negative balance on your account, 1% of that amount will be the charge you have to pay back as an interest. For instance in case you have withdrawn an overdraft of 100,000/-, you will be charged 1000/- the following day.

You typically won't know your credit limit until you've completed an application and it is approved.You will be offered a credit limit or an overdraft depending on whether you have given a security deposit or not or for a basic level if you meet the requirements set forth below. With your credit Limit, you will be able to withdraw money upto a negative balance on your account.

This means that if you have no balance on your account, NIC GENERAL INSURANCE CO. LTD will offer you up to a maximum of 100,000/- for the basic level where you offer no security deposit. In cases where you are to offer a security deposit, NIC GENERAL INSURANCE CO. LTD will offer you an amount of money that is half of the market price of the security deposit that you offer.

- You need to be 4 people to have access to the credit limit offered by NIC. Each of you will qualify to receive a credit limit of 100,000/= which you can also request for should you be interested.

- You will all be required to register for an account with NIC GENERAL INSURANCE CO. LTD if you have not already done so.

- You will also be required to submit your National IDs/Passport IDs for your identification

- You will then also be required to fill in a form which you will be signing, scanning and then re-submitting for approval. You can be able to access and download the form from here

HOW TO REGISTER FOR AN ACCOUNT

There are two ways through which you can register for an acccount as explained below:

Using the Online NIC GENERAL INSURANCE CO. LTD Portal

- Visit our website to signup for an account in case you do not have one and if you already have one, you can simply signin.

- Follow our link here to learn about how you can submit your documents to our team for approval

- After you have logged in, navigate and click on your name at the top right hand corner and select My Profile.

- Locate My Documents and attach a soft copy of your ID which can be your passport ID, Driving Licence but preferably the National ID in case you have not already done so. Once it is approved and you have already signed the above contract for your Credit Limit, you chaould have access to the funds in your account. If on the other hand you have not received it, you can contact our team so that you can be advised.

You can alternatively use the WhatsApp option to be able to register and be eligible to receive the Credit Limit. You can be able to do so as follows;

- Add our WhatsApp number of +1 619-664-4376 to your numbers

- Send a Hi message to it where you will then receive an automated response from NIC GENERAL INSURANCE CO. LTD

- Select option number 9 of My Account and follow the prompts to submit your National ID

- You will then be given a response that your documents have been received

- Wait for your documents to be verified by the NIC GENERAL INSURANCE CO. LTD team

- Upon verification, you will then be eligible to not only send but also be able to withdraw funds

RENEWAL OF THE CREDIT LIMIT

NIC GENERAL INSURANCE CO. LTD will renew your credit limit every time that you pay it up. This means that if you had a credit limit of say UGX100,000 and you withdrew say UGX50,000, if you paid up the UGX50,000 plus interest you can then be able to qualify again for the UGX100,000 credit limit.

You can make purchases all the way up to your credit limit. You may not be able to go over your credit limit, though, if you haven't opted-in to having over-the-limit transactions processed. If you don't opt-in, transactions that could put you over your limit will be declined.

stars that you have in your account. This means that the more gold stars you have in your account, the more trustworthy you are to the company as well as the more benefits you are eligible for.

stars that you have in your account. This means that the more gold stars you have in your account, the more trustworthy you are to the company as well as the more benefits you are eligible for. - What does your profile rating mean

- Why you need a profile rating

- What is identity

- Purpose of verifying your identity

- Significance of identity verification

- When is the verification of identity required

- How is the verification of identity carried out

WHAT DOES YOUR RATING SCORE MEAN

Your rating score reflects the quality of your account profile as well as your ability to be eligible for certain benefits. NIC GENERAL INSURANCE CO. LTD uses this score and other stats from your profile to determine your level of trust as well as your ability to get certain benefits which otherwise you would not get if you had no rating.

If your star in your account is

(gray) in color as can be seen in the screenshot above, it means your account will have some limitations on it such as you will not have the ability to withdraw, you will not have access to a credit limit among other benefits that are provided by the company.

(gray) in color as can be seen in the screenshot above, it means your account will have some limitations on it such as you will not have the ability to withdraw, you will not have access to a credit limit among other benefits that are provided by the company.If the star in your account on the other hand is gold as can be seen in the screenchot above, it means that you atleast have one star in your account which gives you access to certain benefits such as mentioned before. You earn one gold star when you have provided your identification documents such as your National ID or Passport ID.

WHY YOU NEED TO VERIFY YOUR IDENTITY

Identity verification is a step beyond identification although it is still a step short of authentication. When we are asked to show a driver’s license, national id, passport, or other similar form of identification, this is generally for the purpose of identity verification, not authentication. This is the rough equivalent of someone claiming the identity "Kizito John," us asking if the person is indeed Kizito John, and being satisfied with an answer of "Sure I am" from the person (plus a little paperwork). As an identity verification, this is very shaky, at best.

We can take the example a bit further and validate the form of identification—say, a passport—against a database holding an additional copy of the information that it contains, and matching the photograph and physical specifications with the person standing in front of us. This may get us a bit closer, but we are still not at the level of surety we gain from authentication. Identity verification is used not only in our personal interactions but also in computer systems. In many cases, such as when we send an e-mail, the identity we provide is taken to be true, without any additional steps taken to authenticate us.

WHAT IS IDENTITY

Identity is the set of unique traits and characteristics associated with a unique and irreplaceable individual. This becomes essential when we talk about people and especially within the online environment, where identity theft is a more common phenomenon than we think. NIC GENERAL INSURANCE CO. LTD carries out identity verification upon document submission where after a user earns one gold star and then the color of their star changes to gold from the gray color.

PURPOSE OF VERIFYING IDENTITY

As more transactions move online, digitization of the ID verification process can drive significant efficiencies and create new channels for businesses to serve their customers; such as taking manual, face-to-face verification and streamlining it via online platforms. While many business processes are being modernized via digital technologies, ID verification is still slow, manual and prone to human error.

Unfortunately, ineffective manual ID verification is common place across both B2C and B2B companies. This typically results in bad customer experiences, fraud, and failure to maintain regulatory compliance. For many organizations, the ability to accurately verify ID in a timely manner is essential for business to function, allowing for the creation of contractual agreements, compliance with regulations, and delivery of services to customers.

By using digital technology to automate ID verification, organizations provide a smoother and more consistent experience for employees, customers and staff. This technology helps make it possible to onboard new employees who are working remotely, by scanning I-9 forms validating employee IDs digitally. Crucially, it minimizes risk by providing higher signer assurance, and facilitates compliance with regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML).

SIGNIFICANCE OF IDENTITY VERIFICATION

Maintain or Improve Your Reputation: Reputation is incredibly important for businesses of all sizes. In an age where there is so much consumer choice, it’s easy for people to hop from one brand to another if they don’t get exactly what they want. On top of this, trust is more important than ever before as consumers actively seek out businesses they can rely on. In an era of continual data breaches, consumers want to know that their information is safe. By running identity verification checks, this signals that you’re serious about building trust in what’s becoming an unsafe online world.

Avoid Costly Fines: Most businesses simply can’t afford a huge fine of this size, which is why AML and KYC systems are so important. AML refers to a collection of regulations, laws, and procedures that have been specifically constructed to stop the practice of declaring illegally obtained funds as legitimate income. This goes hand-in-hand with the need for KYC, which is essentially the process businesses go through to identify their customers and assess the risk of illegal activities.

Adhering to both of these protocols is important if you want to avoid costly fines – or, in some worst case scenarios, imprisonment. Implementing streamlined, efficient identity verification software and practices aligns with AML and KYC requirements, which means businesses that use them sidestep any potential fines. There are plenty of other individual rules and regulations that apply to businesses too depending on where they’re based and the customers they serve.

Avoid Costly Chargebacks: Credit card fraud makes up a huge portion of the total number of identity fraud cases every year. When businesses began allowing their customers to use credit cards for online purchases, it became far easier to commit fraud since most transactions fell into the “card-not-present” category. As a result, people would fraudulently use credit cards that weren’t theirs to buy goods online and, once the real owner of the card found out, would cancel the transaction.

Without being able to identify and trace the original fraudster, the business would be liable to pay back the money. This is known in the finance world as a chargeback. Unfortunately, they can be a costly part of business for companies that accept credit card payments (the industry standard rate is 1%). Identity verification stops this in its tracks by fully verifying each and every customer. For many businesses, preventing costly chargebacks is simply a case of revising identity verification protocols for card-not-present transactions so that they incorporate one or more identification methods (say, for example, facial recognition or a two-step verification process).

Tighter verification methods can also stop cases of “friendly fraud” in its tracks, too.Verification of identity increases customer trust because it creates a higher level of confidence that a person is who they say they are. Identity verification also ensures that there is a real person behind a process thus preventing both a person from carrying out a process on our behalf without authorization, and creating false identities or commit fraud.

Avoid Fraud and Money Laundering Concerns: Even an accusation of money laundering – however small – can spell the end of the road for a business, regardless of its size. As a result, organizations are leaning more and more towards using risk-based models that incorporate identity verification to assess which users might be high risk. They can then use this data to create authentication levels based on the risk potential of certain transactions (and then mark those that are good and those that might be fraudulent accordingly). This is becoming increasingly important as the business landscape gets more and more digitized. Making sure customers are who they claim to be is a major component in creating digital trust.

Improve Customer Experience: Today, consumers want a customer-centric experience with every business they buy from, and a great user experience strives to reduce any barriers that consumers might have while simplifying processes. The term "frictionless" is often thrown around in relation to good identity verification processes – this means not asking the customer for too much information and instead obtaining information about them in other places.

This means you can create a well-oiled, digital workflow that eliminates most – if not all – need for manual entry and paperwork which can often take a number of days to process. As a result, customers get a smoother onboarding experience and, more importantly, can get instant access to your product or service.

WHEN IS THE VERIFICATION OF IDENTITY REQUIRED

Verification is needed as soon as you have registered for an account. However, this does not prevent you from receiving a payment from your clients who may want to make a payment to you. In such cases where you may not have your ID with you, NIC would allow you to receive the payments but then require to submit your ID when you are going to withdraw the money.

HOW IS THE VERIFICATION OF IDENTITY CARRIED OUT

NIC GENERAL INSURANCE CO. LTD will do a preliminary investigation on the documents that you submit to make sure that there is consistency in the person creating the account. This is done by matching the names on the ID submitted with the account that was created. In case these two do not match, your ID will not be approved otherwise if all is OK, your documents will be approved by the NIC GENERAL INSURANCE CO. LTD team.

Thereafter where necessary, NIC GENERAL INSURANCE CO. LTD may even contact you where necessary to confirm if you are who you say you are in regards to the submitted documents.

Who are Sales Agents?

Sales Agents are also known as Securities and Commodities Sales Agents and they basically do business on behalf of individuals, businesses and or organizations with authorization. Their job is to basically buy and sell securities in investment and trading firms and develop and implement financial plans for individuals, businesses, and organizations.

What do Sales Agents do?

Sales Agents keep accurate records of transactions by reviewing all security transactions to ensure accuracy of information and conformance to governing agency regulations.

They do also carry out the following tasks:

- Complete sales orders and submit them for processing of client-requested transactions.

- Contact prospective customers to determine customer needs, present information, or explain available services.

- Interview clients to determine clients’ assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Develop financial plans, based on analysis of clients’ financial status.

- Analyze market conditions to determine optimum times to execute securities transactions.

- Review financial periodicals, stock and bond reports, business publications, or other material to identify potential investments for clients or to keep abreast of trends affecting market conditions.

- Inform and advise concerned parties regarding fluctuations or securities transactions affecting plans or accounts.

What are Agent Payments?

Sales Agents are also known as Securities and Commodities Sales Agents and they basically do business on behalf of individuals, businesses and or organizations with authorization. Their job is to basically buy and sell securities in investment and trading firms and develop and implement financial plans for individuals, businesses, and organizations.

What do Sales Agents do?

Sales Agents keep accurate records of transactions by reviewing all security transactions to ensure accuracy of information and conformance to governing agency regulations.

They do also carry out the following tasks:

- Complete sales orders and submit them for processing of client-requested transactions.

- Contact prospective customers to determine customer needs, present information, or explain available services.

- Interview clients to determine clients’ assets, liabilities, cash flow, insurance coverage, tax status, or financial objectives.

- Discuss financial options with clients and keep them informed about transactions.

- Develop financial plans, based on analysis of clients’ financial status.

- Analyze market conditions to determine optimum times to execute securities transactions.

- Review financial periodicals, stock and bond reports, business publications, or other material to identify potential investments for clients or to keep abreast of trends affecting market conditions.

- Inform and advise concerned parties regarding fluctuations or securities transactions affecting plans or accounts.

Below you will find some of the types of accounts that you can be able to open up and the required documents for each. You can jump to particular sections of these documents by using the following links below:

- Individuals

- Limited Companies

- Sole Proprietor

- Savings and Credit Cooperatives (SACCOs)/Non-deposit taking microfinance institutions/ /Money Lending companies

- Non-Governmental Organizations

- Community based organizations, Clubs and Associations

- Faith Based Organizations – Churches, Mosques etc

- Schools, Education Institutions

- Partnerships

- Embassies

- Trusts

- Political Parties

- Ministries/Public Sector/Government

- Banks Financial Institutions

- Why should you submit your documents?

- How do you submit documents to NIC GENERAL INSURANCE CO. LTD?

What kind of documents can you submit to NIC GENERAL INSURANCE CO. LTD?

INDIVIDUALS

The following documents are required to be submitted by the applicant in the process of creating an account for individuals

- Identification Documents (Acceptable IDs)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID ➢ National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

- Proof of residence/ address verification include any of the following

- Letter from a public authority or embassy or consular office

- Utility Bills in the customer’s name and not older than 3 months

- Where utility bill is not in the name of the customer obtain a copy of the tenancy agreement

- Letter of recommendation from employer

- LC Letter confirming residence

- Letter from School/ University administration in case of students

- Bank statement from existing or previous bank bearing the current customer’s address.

- Certificate of residence for foreigners

- Proof of Income/Source of Income

- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for Limited Companies

- Certified board resolution to open account stating authorized signatories

- Certificate of Incorporation certified by the Company Registrar

- Certified Memorandum and Articles of Association

- Certified Particulars of Directors and Secretaries i.e. Form 20 (formerly form 7)/Notification of change of directors and company secretary

- Certified copy of Particulars of Business Address i.e Form 18 (formerly form A9)

- Trading License. A company licenced under a different law, should submit a copy of the applicable license

- Tax Identification Number (TIN), or Tax Exemption Certificate

- Company search

- Identity Documents of related parties and beneficial owner.

A beneficial owner is an individual with shareholding > 10%, A related party is a Director and authorized Account Signatories.- Letter of recommendation/appointment/confirmation from employer

- Payslip not older than 3 months

- Declaration of Income form

- Trading License

- Work Permit (only applicable to Foreign Nationals)

- Financial statements for a company older than a year

- Memorandum/Articles of association for a company that has been in existence for less than a year

The following documents are required to be submitted by the applicant in the process of creating an account for sole propretors

- Certificate of registration of Business Name Certified by the Company Registrar

- Statement of particulars pursuant to the registration of business name

- Trading License

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

The following documents are required to be submitted by the applicant in the process of creating an account for SACCOS

- Certified copy of the certificate of registration of the SACCO issued under Cooperatives Societies Act

- License from Tier 4 Microfinance Institutions Authority

- Constitution/ By Laws or Certified Memorandum and Articles of Association of the entity

- Identity Documents of Primary and related parties such as Directors and Account Signatories. (National ID for nationals OR Passport for Foreigners OR Refugee ID for refugees)

- Minutes authorising account opening and appointing current management and signatories

- Letter requesting for account opening stating signatories

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- A letter from a public authority or embassy or consular office.

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for NGOs.

- Certified Copy of License from the NGO board

- Certified copy of Certificate of Registration/Incorporation

- Constitution/ By Laws Or Certified Memorandum and Articles of Association

- Registered resolution indicating the current Board members/Executive committee & period of validity in office. In case of any change another resolution and Minutes electing the current sitting Board should be shared

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- National IDs, Passports, Employment ID, Driver’s License and NSSF Card. Preferred ID > National ID

- Passports are the ONLY acceptable form of identification proof for foreign nationals and Work Permit/Certificate of residence

- FATCA form for US Nationals

- Refugees: Refugee ID Minors: The minor’s information, birth certificate/Health cards and photos must be obtained. While the minor’s Guardian who will operate the account MUST provide Individual requirements

- Students: National ID/Student ID

The following documents are required to be submitted by the applicant in the process of creating an account for CBOs, Clubs and Associations

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Minutes of meeting resolving to open the account and stating signatories

- Constitution/ By Laws or Certified Memorandum and Articles of Association

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address

- Tenancy or Lease Agreement

- a letter from a public authority or embassy or consular office

- Proof of Address i.e. Certified copy of company form 18 (formerly A9)

The following documents are required to be submitted by the applicant in the process of creating an account for FBOs, Churches and Mosques

- A recommendation letter to open an account from the Vicar/Secretariat of the religious faith for the mainstream churches/mosques

- Authorization to Open account duly signed by Board Members/ Executive committee stating signatories

- Identity Documents of Primary and related parties, Directors, Account Signatories (National ID for nationals OR Passport for Foreigners OR Refugee ID and Refugee attestations for refugees)

- Constitution/Charter

- Proof of Address any of the following below can be obtained

- Recent Utility bills not older than three months

- Bank Statement bearing customer’s address